5 Metrics to Evaluate AI Stocks That Separate Winners From Pretenders

5 Metrics to Evaluate AI Stocks That Separate Winners From Pretenders

Wall Street analysts obsess over TAM projections and buzzword bingo. Here’s what actually separates the AI companies printing money from the ones burning cash—with Broadcom’s just-released earnings proving the point.

Everyone’s an AI expert now. Your Uber driver has AI stock picks. Your cousin just pivoted his lawn care company to be “AI-powered.” And Wall Street analysts are falling over themselves to publish reports with titles like “The $15.7 Trillion AI Opportunity” while offering zero actionable intelligence on which companies will actually capture that value.

This guide breaks down the best metrics to evaluate AI stocks—so you can spot who will win the capex arms race and who will dilute shareholders.

Here’s the uncomfortable truth: most AI investments will fail. The question isn’t whether AI will transform industries—it will. The question is which companies have the financial architecture to survive the brutal capex war, maintain pricing power as competition intensifies, and convert hype into actual shareholder returns.

This week’s Broadcom earnings provided a masterclass in what separates AI winners from AI pretenders. While the stock jumped 13% after-hours on “AI revenue grew 220%,” the real story was in the margins, the capex efficiency, and the moat-building that most coverage completely missed.[1]

“The risk of under-investing is dramatically greater than the risk of over-investing.”

— Sundar Pichai, Alphabet CEO, on AI capex

That quote tells you everything about the current AI arms race. Every hyperscaler is terrified of being left behind. But not all AI bets are created equal. Some companies are building durable competitive moats. Others are lighting money on fire for the privilege of saying “AI” on their earnings calls.

What Are the Best Metrics to Evaluate AI Stocks?

If you want to know how to pick AI stocks that will actually deliver returns, skip the hype and focus on these five financial metrics:

The 5 Metrics That Matter:

→ Gross Margin Trend — Reveals pricing power in semiconductors and whether a company can charge premium prices

→ Capex Discipline — Shows if AI infrastructure spending is funded from strength or desperation

→ Revenue Per Employee — The productivity moat that signals scalability and business model quality

→ Pricing Power — Whether customers have real alternatives or are locked into the ecosystem

→ Moat Proof — Structural advantages that compound over time (think NVIDIA CUDA moat or Broadcom custom silicon)

Let’s break down each metric with real data from the latest earnings reports.

1. AI Stocks Gross Margin: The Pricing Power Litmus Test

Gross margin isn’t sexy. It doesn’t make headlines. But it’s the single best indicator of whether a company can charge premium prices and make it stick. In a commoditizing market, gross margins compress. In a market where you’re selling something indispensable, they expand.

Elite (70%+)

Improving (50-70%)

Look at that spread. NVIDIA and Broadcom are operating with software-like margins while selling physical hardware. That’s not normal. That’s pricing power born from genuine scarcity and mission-critical positioning.

The trend matters more than the absolute number. Broadcom’s Q4 gross margin was up 260 basis points year-over-year.[1] NVIDIA’s margins have been stable despite competitors launching “NVIDIA killers” every quarter. AMD, despite strong execution with the MI300 series, is improving but still operating in a different tier—their Q4 2024 non-GAAP gross margin hit 54%, up 330 bps year-over-year, showing meaningful progress.[4]

What to Watch

Margin compression signals commoditization. If NVIDIA’s gross margins drop below 70%, it means ASICs and custom silicon are gaining real traction. So far, that hasn’t happened—and NVIDIA’s forward guidance for 73.5% suggests they expect pricing power to hold.[2]

📢 This Week’s Signal: Broadcom Custom Silicon XPU

Broadcom’s AI revenue hit $12.2 billion for fiscal 2024—up 220% year-over-year. But here’s what matters: they did it while expanding margins. Their custom AI accelerators (XPUs) for hyperscalers like Google, Meta, and ByteDance are commanding premium pricing. CEO Hock Tan’s projection of a $60-90 billion serviceable addressable market by 2027 isn’t hype—it’s backed by contracted customer commitments.[1]

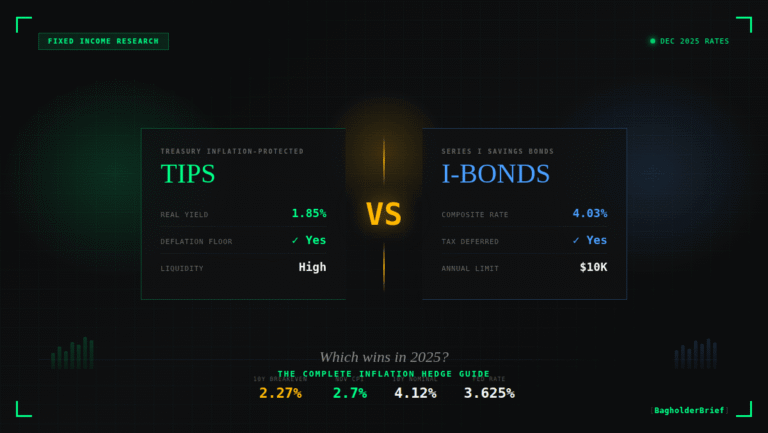

2. AI Capex Spending 2025: The Survive-to-Thrive Ratio

AI infrastructure requires staggering capital investment. The top hyperscalers are on pace to spend $350-380 billion on capex in 2025 alone—significantly higher than earlier estimates.[5] But there’s a critical distinction between investing from strength and desperately throwing money at the problem.

Cloud Revenue Funded

Indirect AI Bet

The question isn’t how much they’re spending—it’s whether the cash machine can sustain the investment without financial stress. Google’s search monopoly prints so much cash they started paying dividends in 2024 while simultaneously ramping AI capex. Microsoft’s Azure business generates recurring revenue that funds the AI buildout. Amazon’s AWS infrastructure creates a virtuous cycle.

Meta is the outlier. Their capex forecast jumped to $70-72 billion from earlier guidance of $60-65 billion. Unlike the cloud providers, Meta doesn’t have a direct AI revenue story—they’re betting that AI improves ad targeting enough to justify the spend. That’s a higher-risk capital allocation strategy, and CEO Zuckerberg has signaled 2026 could see spending approach $100 billion.[5]

Understanding how macro factors like capex cycles, yields, and the dollar affect multiples is essential context for evaluating these infrastructure bets.

3. Revenue Per Employee Metric: The Productivity Moat

This metric reveals something profound about business model quality. When a company generates $3.6 million in revenue per employee (NVIDIA) versus $410,000 (Amazon), that’s not just an efficiency difference—it’s a structural competitive advantage.

💡 NVIDIA: $2M Net Income Per Employee

More than 50x Amazon’s profit per employee. This is what happens when you own the picks and shovels in a gold rush—and the picks are protected by a software moat called CUDA.

Revenue per employee matters because it signals scalability. NVIDIA achieves this with just 36,000 employees—six times fewer than Microsoft’s 228,000. This lean structure means faster decision-making, less bureaucratic drag on innovation, and more profit to reinvest in R&D or return to shareholders.

4. Pricing Power in Semiconductors: Can They Raise Prices Without Losing Customers?

NVIDIA charges a significant premium over AMD’s MI300X GPUs. Customers still can’t get enough. That’s pricing power in its purest form.

But pricing power isn’t just about charging more—it’s about whether customers have meaningful alternatives. NVIDIA’s CUDA software ecosystem, developed over nearly two decades, creates profound lock-in. Migrating a production AI workload from CUDA to AMD’s ROCm requires months of engineering time for code porting, risk of performance degradation, retraining development teams, and uncertainty about library support.

“Even if competitors’ chips are free, customers would still choose NVIDIA due to the opportunity cost—possibly losing 30x the revenue from lower performance.”

— Jensen Huang, NVIDIA CEO

For most enterprises, the switching cost exceeds any hardware savings. That’s a moat.

5. How to Measure an AI Moat: What Makes Them Defensible?

Talk is cheap. Patents expire. First-mover advantage fades. The only moats that matter are structural advantages that compound over time.

NVIDIA CUDA Moat: The Ecosystem Lock-In

4+ million developers trained on CUDA. Decades of optimized libraries. The entire AI research community publishes code that assumes NVIDIA hardware. This isn’t a moat you can build in a quarter—or a year.

Broadcom Custom Silicon XPU: Customer Intimacy

They’re designing custom silicon for specific hyperscaler workloads. Google’s TPU architecture, ByteDance’s inference chips, Meta’s training accelerators—Broadcom is the trusted manufacturing partner. Switching costs are astronomical because the IP is co-developed.

Microsoft’s Moat: Distribution + Integration

Azure runs on enterprises that already use Office 365, Teams, Dynamics. Copilot integrates into workflows 800 million people use daily. The AI features aren’t a product—they’re a sticky upgrade to an existing relationship.

The Red Flag: Cost-Based Competition

AMD’s pitch is essentially “competitive performance, better value.” That works for gaining market share, but it’s not a durable advantage. AMD’s improving margins (54% non-GAAP in Q4) show they’re executing well, but NVIDIA could cut prices tomorrow if needed—their margin cushion is massive.

For more on why patience and compounding matter when holding quality AI names through volatility, see our long-term investing framework.

The Bottom Line: Where Quality Meets Opportunity

The AI infrastructure buildout is real. The $350+ billion in hyperscaler capex isn’t speculation—it’s contracted spending backed by the most profitable companies on earth. But within this mega-trend, there are clear tiers of quality.

Highest Quality: NVIDIA and Broadcom. Both have expanding margins, structural moats, and pricing power that’s been tested and proven. Valuations are rich, but the fundamentals justify premium multiples.

High Quality: Microsoft and Alphabet. Distribution advantages and self-funding capex programs make these defensive AI plays. Less upside than pure-play semis, but lower risk of permanent capital impairment.

Improving / Higher Risk: AMD and Meta. AMD’s improving margins (54% non-GAAP) and strong data center growth show real execution, but the moat remains narrower than NVIDIA’s. Meta’s capex ramp without clear AI revenue attribution carries higher risk.

Watch how institutions are positioning around AI earnings through options flow analysis—it often reveals sentiment before the market moves.

Key Takeaways:

→ Gross margins separate winners from pretenders—Broadcom (76.9%) and NVIDIA (73.5%) operate at software-like levels.

→ Hyperscaler AI capex spending 2025 is approaching $350-380B, but only cloud-funded companies can sustain the spend.

→ NVIDIA’s CUDA ecosystem creates switching costs that exceed any hardware savings competitors offer.

→ Revenue per employee reveals structural advantages—NVIDIA generates 50x more profit per employee than Amazon.

→ In a gold rush, sell picks and shovels. But not all picks are created equal—the winners have pricing power and ecosystem lock-in.

Frequently Asked Questions

What’s the single most important metric for AI stocks?

Gross margin trend. It reveals whether a company has genuine pricing power or is competing on cost. Companies like NVIDIA (73.5%) and Broadcom (76.9%) maintain software-like margins on hardware—a clear sign they’re selling something indispensable. If margins compress, it signals commoditization and competition catching up.

Are high gross margins sustainable in AI chips?

For companies with structural moats, yes. NVIDIA’s CUDA ecosystem and Broadcom’s custom silicon partnerships create switching costs that protect margins. However, margins could compress if custom ASICs gain traction or if hyperscalers successfully develop in-house alternatives. Watch for margin guidance below 70% as an early warning sign.

Does hyperscaler capex guarantee semiconductor winners?

No. Massive AI capex spending ($350B+ in 2025) benefits suppliers, but the question is which suppliers. NVIDIA and Broadcom capture the highest-margin segments. Commodity component makers see less benefit. Also consider that not all capex translates to semiconductor purchases—data centers, power infrastructure, and real estate consume significant portions.

How do you measure an AI moat?

Look for switching costs and ecosystem lock-in. The NVIDIA CUDA moat includes 4+ million trained developers, decades of optimized libraries, and an entire research community built on their platform. Broadcom’s custom silicon XPU moat comes from co-developed IP with hyperscalers. A true moat means customers stay even when cheaper alternatives exist.

Is Broadcom an AI winner or a cyclical hardware play?

Broadcom has successfully transitioned to an AI winner. Their custom AI accelerator (XPU) business generated $12.2 billion in fiscal 2024—up 220% year-over-year—while expanding margins. Unlike cyclical hardware plays, Broadcom’s relationships with hyperscalers (Google, Meta, ByteDance) involve multi-year development partnerships with high switching costs. The $60-90B TAM projection for 2027 is backed by contracted commitments, not speculation.

Why does revenue per employee matter for AI stocks?

The revenue per employee metric signals business model quality and scalability. NVIDIA generates $3.6M in revenue and $2M in profit per employee—50x more than Amazon. This lean structure means faster innovation, less bureaucratic drag, and more capital for R&D or shareholder returns. Companies with high revenue per employee tend to have structural advantages that compound over time.

References & Sources

- Broadcom Inc. “Fourth Quarter and Fiscal Year 2024 Financial Results.” investors.broadcom.com, December 12, 2024.

- NVIDIA Corporation. “NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2025.” nvidianews.nvidia.com, February 26, 2025.

- Microsoft Investor Relations. Q4 FY2024 Financial Data.

- AMD. “AMD Reports Fourth Quarter and Full Year 2024 Financial Results.” ir.amd.com, February 4, 2025.

- CNBC. “How much Google, Meta, Amazon and Microsoft are spending on AI.” cnbc.com

- Yahoo Finance. “Big Tech’s AI investments set to spike to $364 billion in 2025.” finance.yahoo.com

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. Always conduct your own research before making investment decisions. BagholderBrief is not a registered investment advisor. Check our full policy -> Legal