The Mathematics of Patience: A Quantitative Framework for Long-Term Investing & Wealth Creation

The Mathematics of Patience: A Quantitative Framework for Long-Term Investing & Wealth Creation

Why behavioral discipline, not investment selection, explains the majority of wealth divergence among retail investors—and the tax-efficient strategies that compound the advantage.

Long-term investing success depends less on stock picking than on behavior. The most consequential variable in long-term investment returns is not asset allocation, security selection, or even market timing—it is investor behavior. DALBAR’s Quantitative Analysis of Investor Behavior documents a persistent phenomenon: over the 30-year period from 1985-2015, the S&P 500 returned 10.35% annually while the average equity investor earned just 3.66%.[1] This 6.69 percentage point gap—attributable entirely to behavioral errors—represents a fundamental transfer of wealth from impatient to patient investors.

The 2024 data proved particularly instructive. While the S&P 500 returned 25.02%, the average equity investor captured only 16.54%—an 8.48 percentage point underperformance that ranked as the fourth-largest gap since DALBAR began tracking in 1985.[2] Investors withdrew from equity funds in every quarter of 2024, with the largest outflows occurring in Q3—immediately preceding a significant rally.

This report synthesizes research from behavioral finance, tax optimization, and historical market data to construct a quantitative framework for long-term investing & wealth creation. The thesis is straightforward: systematic behavioral discipline combined with tax-efficient execution generates alpha that compounds over decades.

The Behavior Gap: Quantifying the Cost of Human Psychology

Kahneman and Tversky’s Nobel Prize-winning research on loss aversion provides the theoretical foundation for understanding the behavior gap. Investors feel losses 2-2.5 times more intensely than equivalent gains, creating systematic bias toward panic selling at market bottoms and missing subsequent recoveries.[3]

Barber and Odean’s analysis of 78,000 household accounts quantified the damage directly: the most active 20% of traders earned 11.4% annually while the least active 20% earned 18.5%—a 7.1 percentage point advantage for doing less.[4] Their subsequent “Boys Will Be Boys” study demonstrated that men trade 45% more frequently than women and underperform by approximately 1 percentage point annually due to overconfidence.

The most active quintile of traders underperform the least active quintile by 7.1 percentage points annually. Over a 30-year investment horizon, this behavioral difference alone explains a 5x divergence in terminal wealth.

The Mathematics of Missing Market Days

J.P. Morgan Asset Management’s research on market timing provides perhaps the most compelling evidence against tactical allocation. A $10,000 investment in the S&P 500 from January 2005 through December 2024, held continuously, would have grown to $71,750—a 10.4% annualized return.[5]

Missing even a small number of the market’s best days proves catastrophic:

The critical insight: seven of the market’s ten best days occurred within two weeks of the ten worst days.[5] This clustering makes successful market timing virtually impossible—the same fear that drives investors to sell during crashes causes them to miss the recoveries that follow.

The Clustering Problem: Best and Worst Days Are Inseparable

During the 2008 financial crisis, the S&P 500 suffered a 38% decline from September 2008 through March 2009. Yet seven of the market’s ten best days over the past two decades occurred during that same period.[6] The pattern repeated in 2020: the second-worst day of the year (March 12) occurred just four days before the second-best day (March 16).

Best Days

Worst Days

An investor who sold on September 29, 2008 to “avoid losses” would have missed seven of the market’s best days of the decade—occurring within the following six months. The cost of that single decision: approximately 50% of total 10-year returns.

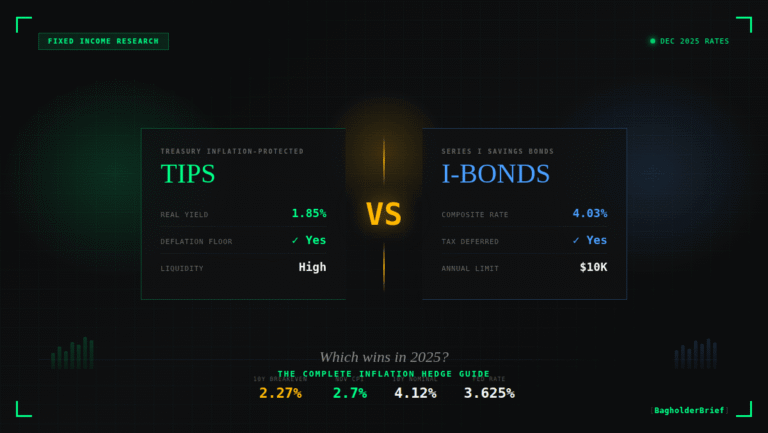

Tax-Efficient Strategies: The Second Alpha Source

Beyond behavioral discipline, tax efficiency represents a second compounding advantage available to long-term investors. The differential between short-term and long-term capital gains rates creates a structural incentive for patient capital.

| Taxable Income (Single) | Short-Term Rate | Long-Term Rate | Savings |

|---|---|---|---|

| $0 – $48,350 | 10-12% | 0% | 10-12% |

| $48,351 – $100,525 | 22% | 15% | 7% |

| $100,526 – $191,950 | 24% | 15% | 9% |

| $191,951 – $243,725 | 32% | 15% | 17% |

| $533,401+ | 37% | 20% | 17% |

For an investor in the 24% marginal bracket, the difference between holding an investment for 364 days versus 366 days represents a 9 percentage point reduction in tax liability on gains—a 37.5% reduction in the tax bill from simply waiting two additional days.[7]

Tax-Loss Harvesting: Converting Losses Into Future Returns

Tax-loss harvesting—selling investments at a loss to offset capital gains—can offset up to $3,000 of ordinary income annually, with excess losses carried forward indefinitely.[8] When reinvested, these tax savings compound over the investment horizon.

Charles Schwab provides a concrete example: an investor who harvests a $25,000 loss to offset a $20,000 short-term gain (at 35% marginal rate) saves $8,050 in taxes immediately—$7,000 on the offset gain plus $1,050 from the $3,000 ordinary income deduction.[9]

“The principle behind tax-loss harvesting is straightforward: you sell an investment that’s underperforming, use that loss to reduce your taxable capital gains, and reinvest the proceeds in a similar investment to maintain your market exposure. The critical distinction: this is a tax management strategy, not a market timing strategy.”

— Vanguard Investment Research

Morgan Stanley research indicates that incorporating tax-efficient strategies can generate approximately 1.6% additional annual return for high-net-worth investors—leading to nearly 73% more wealth accumulation over a multi-decade horizon.[10]

The Compounding Advantage: Time as the Ultimate Multiplier

Einstein likely never called compound interest “the eighth wonder of the world,” but the mathematics remain compelling regardless of attribution. Using the Rule of 72, money earning 10% annually doubles every 7.2 years.

The nonlinearity is critical: 75% of the terminal wealth is generated in the final 15 years. Investors who exit early—whether from behavioral impulse or liquidity needs—sacrifice the most valuable portion of the compounding curve.

Principles from the Masters: A Synthesis

Warren Buffett’s investment philosophy, refined over seven decades, centers on a deceptively simple framework: invest in wonderful businesses at fair prices and hold them forever. His four criteria—understandable business, favorable long-term prospects, honest management, and attractive valuation—eliminate most of the universe immediately.[11]

“Be fearful when others are greedy and greedy when others are fearful.”

— Warren Buffett, 1986 Berkshire Hathaway Letter

Charlie Munger’s contribution—the “latticework of mental models”—emphasized avoiding stupidity over pursuing brilliance: “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”[12]

Benjamin Graham’s margin of safety concept provides the risk management framework: “Confronted with a challenge to distill the secret of sound investment into three words, we venture the motto: Margin of Safety.”[13] The principle persists because markets continue to overshoot in both directions.

John Bogle’s empirical work devastated the case for active management: of 355 equity funds existing in 1970, only 3 (0.8%) demonstrated sustained excellence by 2004-2006. His conclusion—that investors should capture market returns at minimal cost—led to the index fund revolution.[14]

The Long-Term Investing Framework: Systematic Discipline Over Sporadic Brilliance

The evidence converges on a counterintuitive conclusion: investment success depends less on superior analysis than on inferior impulse control. The framework for long-term investing & wealth creation requires:

Behavioral Discipline: Maintain conviction through volatility. The 6.69% annual behavior gap represents not just under-performance but a fundamental transfer of wealth from impatient to patient investors. The best-performing Fidelity accounts, according to industry lore, belonged to investors who forgot they had accounts.

Time Horizon Extension: long-term investing works because historical S&P 500 data shows 100% of 10-year holding periods generated positive returns over the past 82 years. Extending the time horizon doesn’t just improve average returns—it eliminates negative outcomes entirely.

Tax Efficiency: The differential between short-term and long-term rates, combined with systematic tax-loss harvesting, can add 1-2% annually to after-tax returns—a seemingly modest figure that compounds to 50%+ additional wealth over 30 years.

Cost Minimization: Bogle’s data demonstrates that typical investors capture only 57% of index returns after fees. The arithmetic is unforgiving: a 1% expense ratio consumes approximately 25% of total returns over a 30-year horizon.

The difference between successful and unsuccessful investors isn’t intelligence, access, or timing ability—it’s behavior. Investors who maintain conviction through volatility, resist the urge to time markets, and allow compound interest to work over decades consistently build wealth. Those who react emotionally to short-term fluctuations systematically destroy it.

Conclusion: The Only Reliable Path

Current markets—characterized by elevated valuations, concentrated positions in mega-cap technology, and policy uncertainty—make disciplined long-term thinking more critical than ever. The Shiller CAPE ratio stands at 39.51, exceeded historically only during the dot-com bubble and recent pandemic peaks.

Yet the data is unambiguous: investors who stayed invested through the 2020 COVID crash saw 69%+ recoveries within one year. Those who panic-sold during the 2022 bear market locked in losses before the 26% and 25% rebounds of 2023-2024.

Long-term investing rewards patience. The investors who will succeed over the next decade aren’t those who correctly predict short-term market movements—they’re those who understand that time in the market, not timing the market, remains the only reliable path to long-term investing & wealth creation.

The mathematics of patience isn’t complicated. It’s just difficult to execute. That difficulty is precisely what makes it valuable.

References & Sources

- DALBAR, Inc. “Quantitative Analysis of Investor Behavior 2016.” DALBAR QAIB Report

- PLANADVISER. “Investors’ Bad Behavior Led to Sharp Underperformance in 2024.” planadviser.com

- Kahneman, D., & Tversky, A. “Prospect Theory: An Analysis of Decision under Risk.” Econometrica, 1979.

- Barber, B. M., & Odean, T. “Trading Is Hazardous to Your Wealth.” The Journal of Finance, 2000.

- J.P. Morgan Asset Management. “Guide to the Markets Q4 2024.” jpmorgan.com

- CNBC. “Selling out during the market’s worst days can hurt you.” cnbc.com, April 2025.

- IRS. “Topic No. 409, Capital Gains and Losses.” irs.gov

- Vanguard. “Tax-loss harvesting explained.” vanguard.com

- Charles Schwab. “How to Cut Your Tax Bill with Tax-Loss Harvesting.” schwab.com

- Kiplinger. “To Reap the Full Benefits of Tax-Loss Harvesting.” kiplinger.com, October 2025.

- Daily Investor. “Warren Buffett’s top investing principles.” dailyinvestor.com

- The Motley Fool. “Charlie Munger’s Investment Strategy.” fool.com

- Graham, Benjamin. “The Intelligent Investor.” Harper & Brothers, 1949.

- Bogleheads. “John Bogle.” bogleheads.org

Disclaimer: This research report is for informational purposes only and does not constitute investment advice. Past performance does not guarantee future results. All investments involve risk, including potential loss of principal. Consult a qualified financial advisor before making investment decisions. BagholderBrief is not a registered investment advisor. Full Disclaimer -> Legal